Title: Is Cryptocurrency a Form

2025-11-21

In recent years, cryptocurrency has taken the financial world by storm, attracting both investors and enthusiasts alike. Bitcoin, Ethereum, and thousands of other cryptocurrencies have emerged, each promising unique benefits and attributes. One unavoidable question arises amid this digital revolution: Is cryptocurrency truly a form of wealth?

This exploration into the relationship between cryptocurrency and wealth will delve into the implications of digital currencies on traditional wealth perceptions, investment potential, risks, and the future of financial assets in a rapidly changing landscape. In doing so, we'll seek to provide a comprehensive overview of the nuances surrounding cryptocurrency as a form of wealth.

To tackle the question of whether cryptocurrency constitutes wealth, it is essential first to define what wealth is. Traditionally, wealth encompasses a range of financial resources, including money, properties, stocks, and assets that possess tangible value. Wealth is often measured in conventional currencies, such as the US dollar or Euro, and is accumulated through various means including employment, investments, and business activities.

Wealth is not merely the accumulation of assets; it is also a reflection of purchasing power and financial security. Individuals with significant wealth typically have the means to invest in opportunities, secure comfortable living conditions, and provide for their future and the future of their dependents.

As we consider cryptocurrency as a form of wealth, it becomes imperative to assess whether cryptocurrencies meet these conventional definitions. Are they tangible assets? Can they be used for purchasing goods and services? Do they confer financial security?

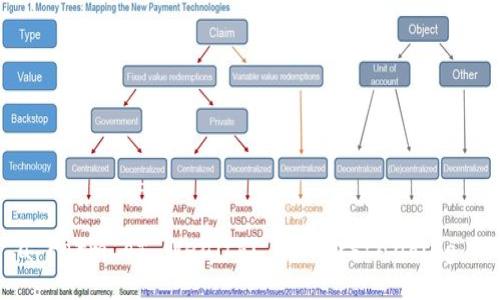

Cryptocurrencies operate on decentralized blockchain networks, which provide a transparent and secure method of conducting transactions without the oversight of central banks or governments. This decentralized nature often appeals to individuals seeking financial independence and an alternative to traditional banking systems.

Most cryptocurrencies have a finite supply, like Bitcoin, which creates scarcity and could theoretically enhance their value over time. This quality adds an investment dimension to cryptocurrency, positioning it as a digital asset akin to traditional wealth instruments like stocks.

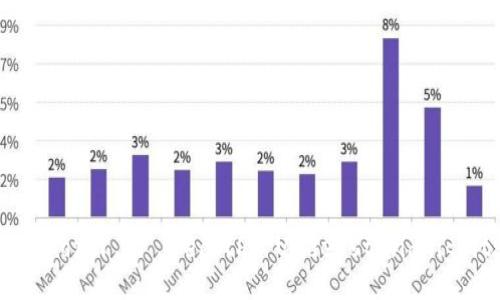

Many people purchase cryptocurrencies with the expectation that their value will increase, sometimes significantly over a short period. However, the fluctuations in cryptocurrency prices can be drastic, which raises questions about their stability and reliability as investments. What constitutes a secure form of wealth is subjective and deeply personal, and this debate occupies a central place in discussions about cryptocurrency.

Traditionally, a store of value is an asset that maintains its value over time and can be retrieved in the future without significant loss of purchasing power. Gold has historically been considered a conventional store of value, whereas fiat currencies may lose value through inflation. With this in mind, are cryptocurrencies able to fill the role of a robust store of value?

Proponents argue that cryptocurrencies, by being designed to limit the total supply, resemble precious metals in that they cannot be artificially inflated. For instance, Bitcoin's maximum supply is capped at 21 million coins, reinforcing its scarcity. Enthusiasts hold the view that cryptocurrencies can insulate holders from inflationary pressures faced by traditional currencies, making them an attractive store of value.

On the other hand, the volatility seen in many cryptocurrencies poses a significant risk, leading some experts to argue against their viability as a store of value. The prices can swing drastically within mere hours, limiting predictability and the assurance that value will be retained over time. This volatility can deter potential holders seeking a stable asset to secure their wealth, emphasizing the complexity of defining cryptocurrency as a legitimate form of wealth.

Regulatory frameworks play a critical role in shaping the perception and acceptance of cryptocurrency as a form of wealth. Governments and financial institutions worldwide are grappling with how to classify and regulate cryptocurrencies, with implications for taxation, ownership, and legal recognition.

In some regions, cryptocurrencies are acknowledged as assets, subject to capital gains taxes, thereby reinforcing their status as a form of wealth. However, in other jurisdictions, cryptocurrencies are viewed with skepticism, often categorized alongside illegal activities due to their anonymity and potential for misuse.

How regulations develop over time will significantly affect public perception and the practicality of using cryptocurrencies as wealth. Should cryptocurrencies gain broader recognition and acceptance within the financial system, they could solidify their position as a legitimate wealth instrument. Conversely, increased regulation could stifle innovation and make cryptocurrencies less appealing as an investment.

While the opportunities within the cryptocurrency landscape appear tantalizing, it’s crucial to consider the associated risks. From technological vulnerabilities, market manipulation, and regulatory uncertainties, to security threats such as hacks and scams, these factors can undermining confidence in crypto as a stable form of wealth.

Moreover, the narratives surrounding cryptocurrencies often inspire strong emotional responses, leading to herd behavior amongst investors. This can result in price bubbles and subsequent crashes, essential cycles that challenge the viability of cryptocurrencies as a reliable wealth option.

Looking optimistically into the future, proponents suggest a path towards a maturing market that incorporates stronger security measures, regulatory clarity, and broader adoption. Educational initiatives that equip potential users with knowledge about risks and informed investment strategies could also play a pivotal role in shaping how cryptocurrencies are perceived in relation to wealth.

Cryptocurrencies differ from traditional assets in several ways, including their decentralized nature, digital form, and unique trading mechanics. Unlike stocks or bonds regulated by centralized entities, cryptocurrencies operate on blockchain technology that enables peer-to-peer transactions. This independence fosters innovation but also introduces volatility and risks not typically encountered with traditional assets.

Investing safely in cryptocurrencies involves conducting thorough research about various cryptocurrencies, understanding the market dynamics, and assessing risk tolerance levels. Additionally, employing strategies such as not investing more than you can afford to lose, using reputable exchanges, and enabling two-factor authentication on wallets and exchange accounts can enhance security measures.

Volatility in interest rates influences not just individual investment decisions, but broader economic trends. High volatility in cryptocurrencies can lead to rapid wealth accumulation or financial losses, creating challenges for long-term investors. Moreover, extreme price fluctuations can lead to a lack of trust in cryptocurrencies, affecting adoption rates and further market stability. Regulatory viewpoints can either mitigate or exacerbate these implications.

Cryptocurrencies can both alleviate and exacerbate wealth inequality. They provide new opportunities for wealth creation, particularly for those in underbanked regions. However, the technical knowledge required, alongside obstacles like access to reliable internet, can hinder those from socio-economically disadvantaged backgrounds from participating in the cryptocurrency market fully. Wealth gaps can widen if cryptocurrencies' benefits favor the tech-savvy and affluent.

The future of cryptocurrencies and their role in wealth accumulation remains uncertain. As technology evolves and regulations become clearer, cryptocurrencies could either cement their status as legitimate assets or revert to niche products. Predictions are divided; some see them as an evolved form of investment, while others caution about potential pitfalls, emphasizing the need for continuous market education, regulation, and technological safeguards.

--- The exploration above delves into how cryptocurrencies are perceived and their implications relative to wealth in contemporary finance, addressing critical questions and areas of consideration. The evolving nature of this space implies ongoing discussions and adaptation from both the investor community and regulatory bodies.